Articles

Latest Articles

Weekly Update 2 June 2025

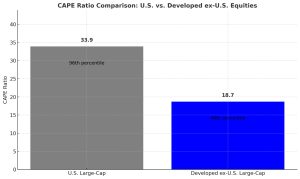

The CAPE ratio (Cyclically Adjusted Price-to-Earnings ratio), also known as the Shiller P/E, is a valuation measure for equity markets. It is calculated as:

Weekly Update 26 May 2025

Over the past 35 years, U.S. equities have outperformed their international peers by an impressive 4.7% per year.

Weekly Update 19 May 2025

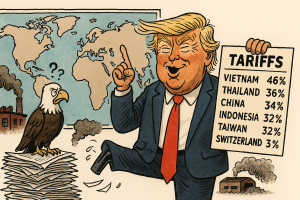

The $SPX500 (SPX500 Index (Non Expiry)) has not only recovered its April losses but continued to rally as tariffs have been, at least temporarily, rolled back. Still, I remain cautious on U.S. equities for several reasons:

Weekly Update 12 May 2025

Markets are rallying today in response to the U.S.–China tariff truce.

Weekly Update 5 May 2025

The portfolio reached a new all-time high in U.S. dollar terms last week.

Weekly Update 21 April 2025

Our portfolio has significantly outperformed the MSCI World index this year, as rising political uncertainty and a slowing US economy have weighed on the S&P 500.

Weekly Update 14 April 2025

Recent market volatility has been intense, with daily swings of several percent becoming normal.

Weekly Update 7 April 2025

Today the main headline in newspapers is that the markets are ‘crashing’, ‘tumbling’ and ‘in free fall’.

Weekly Update 24 March 2025

Risk should be viewed in two ways: as the possibility of loss, but also as the possibility of missing out on gains.

Weekly Update 17 March 2025

The prevailing tone on the stock market this year has been caution.

Weekly Update 10 March

The portfolio performed well last week. It is up +11% for the year, outperforming the MSCI World index by 10 percentage points.

Weekly Update 3 March 2025

Stocks are currently grappling with a mix of positives and negatives.

Weekly Update 24 February 2025

$SPX500 dropped almost 2 percent on Friday due to disappointing US economic data.

Weekly Update 17 February 2025

The prospects of an end to the war in Ukraine have been moving closer.

Weekly Update 3 February 2025

On Saturday Donald Trump announced a 25% tariff against Canada and Mexico and a 10% tariff against China.

Weekly Update 27 January 2025

The certificate below attests that my strategy has been profitable for 4 years in a row. Over this time, the strategy has returned +126%, or 22.6% per year.

Weekly Update 20 January 2025

One reason why US stocks did so well in 2024 is that the US dollar strengthened.

Weekly Update 13 January 2025

2025 has started weakly, due to interest rates increasing and the euro losing value.

Weekly Update 6 January 2025

2024 was a year when the assets I like the least performed the best.

Weekly Update 23 December 2024

This year has been a difficult one for Value stocks. In the last few weeks Value stocks declined for 14 consecutive days, the longest losing streak in history.

Weekly Update 10 December 2024

Two European Chemicals companies were added to the portfolio last week.

Weekly Update 3 December 2024

Bank of America last week published its 2025 market outlook.

Weekly Update 18 November 2024

Trump’s second term presents both opportunities and risks for the portfolio.

Weekly Update 11 November 2024

The portfolio has suffered from weak relative performance lately.

Weekly Update 4 November 2024

US outperformance this year extends a trend that has been in place since 2009.

Weekly Update 28 October 2024

The 2024 US presidential election will be held on 5 November.

Weekly Update 21 October 2024

Goldman Sachs analyses what kinds of returns investors can expect.

Weekly Update 30 September 2024

Markets have had to digest a few surprises over the past couple of weeks.

Weekly Update 23 September 2024

Over the past 10 years, US fund investors made 6.3% a year.

Weekly Update 16 September 2024

Clifford Asness argues that the stock market has become less efficient over the past 30 years.

Weekly Update 9 September 2024

Santander is a large global bank serving 168 million customers.

Weekly Update 12 August 2024

The 2020s will offer many opportunities to make money from major macro events and trends.

Weekly Update 5 August 2024

Today people got scared and sold simply because others were selling.

Weekly Update 29 July 2024

What is the outlook for the global economy over the next 10 years?

Weekly Update 8 July 2024

A number of indicators suggest that inflation has been brought back under control.

Weekly Update 29 April 2024

Last week’s earnings confirm the thesis I have about European banks.

Weekly Update 4 March 2024

Our portfolio is in banks, insurance companies and energy companies.

Weekly Update 29 January 2024

It would be dangerous to look at past 10-15 year returns when evaluating Value stocks.

Weekly Update 22 January 2024

What can we say about the prospects of the US vs the rest of the world?

Weekly Update 18 December 2022

Many investors will be wondering if the market can go higher from here or if it might be a good time to sell.

Weekly Update 4 December 2023

The annual eToro Popular Investor Summit took place in Abu Dhabi last week.

Weekly Update 20 November 2023

The investment case for banks remains strong from these levels.

Weekly Update 16 October 2023

The ???????????????????????????????????? ???????????????????? published an article this weekend about copy trading.

Weekly Update 18 September 2023

60% of fund managers have no direct stake in the performance of their funds.

Weekly Update 11 September 2023

A successful investor cannot base their strategy only on published results.

Weekly Update 4 September 2023

Why the majority of my portfolio is invested in European banks.

Weekly Update 14 August 2023

Over the past 10 years, investors lost to the funds they invested in by 1.7% a year.

Weekly Update 7 August 2023

If the economy experiences a soft landing, we would expect commodities and banks to perform well in H2 2023.

Weekly Update 31 July 2023

Many investors were cautious at the beginning of the year, but the market ($SWDA.L) has returned +19% for the year to date, our portfolio +20%.

Weekly Update 17 July 2023

UK banks have underperformed continental European banks this year.

Weekly Update 10 July 2023

Inflation is finally starting to come down. Owing to elevated wage growth (6%), inflation is running at a high rate (5%). www.atlantafed.org/chcs/wage-growth-tracker www.clevelandfed.org/en/indicators-and-data/inflation-nowcasting However, trend

Weekly Update 3 July 2023

The first half of the year closed with a +13% return. It was a good start to the year in absolute terms, but in relative

Weekly Update 26 June 2023

Our strategy has performed poorly since the end of January, with a -7% return. Banks, our main focus, have underperformed this year. A few banks

Weekly Update 19 June 2023

Growth stocks extended their lead over Value stocks last week. $VUG has beaten $VTV by 30 percentage points this year (+32% vs +2%). Given the

Weekly Update 12 June 2023

After sell-offs in 2011, 2016, 2018 and 2020 banks rebounded strongly.